2016 Will Be Tough, Reforms or No Reforms – Digest of Belarusian Economy

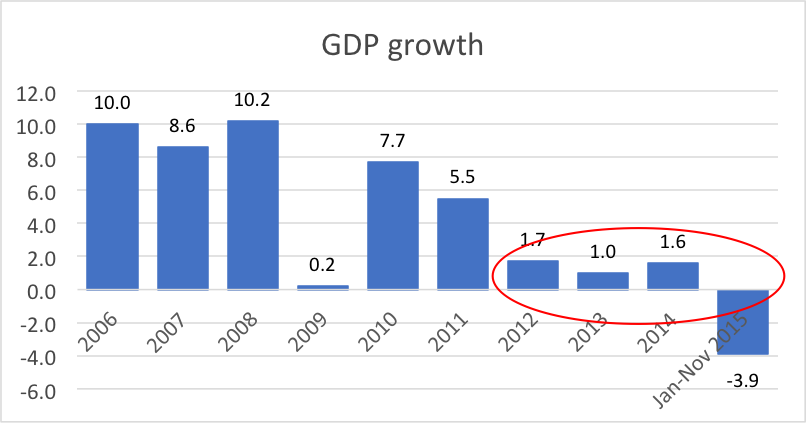

After several years of slow growth, 2015 became the first year of true recession. GDP fell by 3.9 per cent in January-November; employment declined over the year. The Belarusian rouble depreciated by almost 60 per cent.

Despite significant changes in the economic policy, 2016 will not be different. The official outlook (based on the oil price of $50) predicts zero growth, while the independent research centres expect modest decline. The recession is not deep enough to launch reforms quickly, and the positive effects from any possible reforms will come in only after 2016-2017.

The recession of 2015

The 2015 became the first recession year in Belarus after 20 years of economic growth. In January-November 2015 the GDP of Belarus declined by 3.9 per cent. Manufacturing and construction took the hardest hits.

As the Russian economy tumbled down, and the depreciation of the Russian rouble went faster than that of its Belarusian counterpart, Belarusian exporters of manufacturing products lost the Russian market. The exports of goods to Russia declined by one third, despite the rise in the re-exports of the sanctioned products from Europe. The drop in the production was most pronounced for many of the Belarus signature products: harvesters, TV sets, lorry trucks, tractors and textiles.

The current crisis in Belarus is often connected to the drop in oil prices, and this is partially true. Low oil prices affect the Russian economy, Belarus' main trading partner; they also make Belarusian oil refining business less profitable. But another part of the story is the structural problem in the Belarusian economy.

Since 2011 growth rates were too anaemic for the developing economy that Belarus is. The state-owned enterprises are loosing competitiveness on external markets despite luxury conditions within Belarus, and no oil price can return Belarus to the growth rates above 3 per cent without the structural reforms with aim to boost productivity.

The policy switch in 2015

2015 also became a year of economic policy switch, led by the National bank. The National bank finally has abandoned the currency peg, and has let the exchange rates to float. Before 2015, half of devaluation always translated in inflation.

In 2015, with currency devaluation of about 60 per cent over the year, inflation will not surpass 12-13 per cent, according to expectations (Belstat has not released inflation figures for the whole year yet). Despite the difficult year with the dramatic drop in exports, the floating exchange rate absorbed part of the shocks, and the currency reserves did not deplete completely.

The government also changed its behaviour, although less than the National Bank. With 2015 being the election year everyone expected the government to increase wages. Instead the real incomes declined, and the state-owned enterprises massively cut employment.

Unemployment insurance systems as a tool of social protection Formation of an adequate system of social protection and security as a tool to support the unemployed population is becoming one of the most pressing challenges in Belarus. Read more

While this policy worsened the welfare of Belarusians, it allowed achieving macroeconomic stabilisation and avoiding another currency crisis. Another piece of good news is that the government also plans to introduce a proper unemployment insurance, that becomes necessary in time of strict fiscal and monetary policy.

Threats to watch for in 2016

The GDP in 2016 will depend greatly on the oil price, with the independent estimates ranging from -3 to +1 per cent growth rate under different scenarios. But even soaring oil prices will not deliver high growth rates. Growth will become possible only after the structural reforms, and in several years.

Real incomes and employment will be falling or stagnating. If the National bank preserves its independence, the inflation will continue to slow down, and the exchange rate will fluctuate with the oil prices and the Russian rouble.

The banking system and the currency exchange equilibrium continue to be fragile Read more

The banking system and the currency exchange equilibrium continue to be fragile and vulnerable to external shocks. Many state-owned enterprises are drowning in debt, and the current financial situation makes it difficult to service these debts. The series of defaults in payments may cause the banking crisis.

The currency reserves are currently at the critically low level ($4 175.8mln on the 1st of January 2016, lowest level since the crisis of 2011). If some adverse external events hit the economy, the National bank will not have enough reserves to stabilise the situation, and another uncontrolled currency crisis might occur. That is why Belarus needs a loan from IMF or some other party.

Reforms to expect in 2016

The biggest problem of the Belarusian economy today is inefficient state-owned enterprises. Any reforms that aim to generate growth should first of all address this problem. The most obvious way to raise efficiency is to privatise. But so far the government has been reluctant to sell “family silver”, and there are no buyers willing to invest into indebted and inefficient enterprises.

Another way is to reform the management system while preserving the state ownership, but this strategy has rather limited potential. Which way (or combination of ways) the government will go in 2016 remains to be seen, but dealing with this problem will take at least 5-10 years.

government will most likely start implementing unpopular reforms in 2016, raising utilities bills, removing some tax incentives and increasing subsidised tariffs Read more

Public finance and inefficient social security system cause additional problems. Current social security system in Belarus relies mostly on subsidies instead of targeted, means-based support. But the economic crisis means less money in the budget and need to cut expenditures.

The recommendations of IMF and other potential creditors usually feature the demands to cut subsidies. And despite the unpopularity of these reforms, government will most likely start implementing them in 2016, raising utilities bills, removing some tax incentives and increasing subsidised tariffs.

The 2016 will not be much different from 2015. We cannot expect drastic reforms, as the economic crisis is not drastic either. But we can expect small steps towards better economic policy, as we observed in 2015. The volatility of the economy will remain dependent on external shocks, and the beginning of the year suggests there will be a lot of bumps on the road.

Kateryna Bornukova, BEROC

This article is a part of a joint project between Belarus Digest and Belarusian Economic Research and Outreach Center (BEROC)