A New Loan from Russia – A Temporary Lifejacket

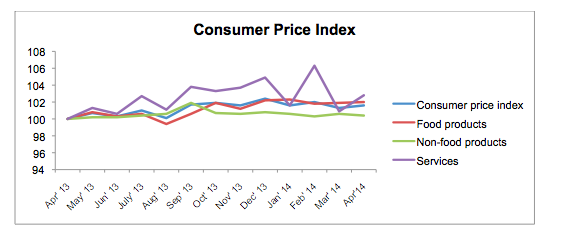

The growth rate of inflation in the 1st quarter of 2014 amounted to 6.6% and made plans for reaching the official targets for annual inflation highly unlikely.

Despite this, a gradual reduction in refinancing rates with a second round of cuts has been preserved. It was also accompanied fixing the maximum rate of ruble loans at a rate of 39.4% for companies.

By the end of April the international reserves of Belarus decreased by $238m, bringing them to a total of $5.477bn. This number signals the lowest amount of reserves that Belarus has seen since November and makes the problem of attracting capital all the more difficult.

However, a new loan from Russia will allow officials to postpone making any macroeconomic adjustment policy decisions for now. The authorities are not keen on introducing any unpopular reforms in a pre-election year.

Inflation and Refinancing Rates

Consumer prices grew by 1.6% in April, and in January-April inflation reached 6.6%. It appears rather obvious at this point that the authorities will not succeed in reaching their planned annual inflation rate of 11% and it will likely rise at least 5-6 points beyond what the government had planned for.

At the same time a reduced refinancing rate of 21.5% was set in April and May and signals the possibility of a decrease in rates for for the Belarusian ruble. This move supports the decision of the National Bank of Belarus (NBB) to fix the maximum interest rates on loans to legal entities in national currency at a maximum rate of 39.4%.

This decision came into force on 8 May 2015 and will be in effect until at least till 1 January 2015. An attempt to make it easier for for the enterprises to access financing is the primary function of this decision. However, there is a good chance that this will boost inflation, with its’ already high rates.

The possibility of rising inflation together with devaluation expectations from average Belarusians may increase the volatility of national exchange rate vs. foreign currencies and decrease demand for the Belarusian ruble.

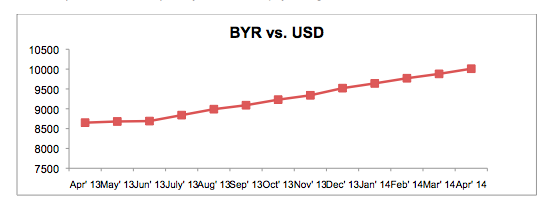

Dynamics of the currency market

Over the past months there has been a noticeable trend on the currency exchange market with U.S. dollar vs. BYR (Belarusian Ruble) finally reaching the psychologically round figure of 10000 BYR for $1.

In general the situation for the currency market remained stable, including its more negative tendencies. In recent months the smooth nominal devaluation of the Belarusian ruble has continued with the main factors influencing the situation being inflation, a decline in foreign currency reserves together with rising devaluation expectations among Belarusians.

Demand for foreign currency serves as evidence of increasing devaluation expectations. In January 2014 the net demand on foreign currency was $(-99)m, while in March 2014 it amounted to just $(-10.3)m. The situation which has developed means that Belarus must attract external sources of financing as only the nation's meagre foreign reserves are available to prop up the Belarusian ruble.

New Loan to Help Stabilise Foreign Currency Reserves

In April, there were no signs of improvement with the foreign exchange reserves of Belarus. The prior downward trend did not abate and a monthly reduction to the tune of $238m hit the state's coffers, while the cumulative drop from January – April 2014 has reach a sizeable $1.2bn. At the beginning of May the total reserves sunk to $5.477bn. This reduction in the nation's currency reserves signals that Belarus has only limited resources available for the maintenance of its economy.

Belarus' inability to attract foreign investment partially explains the dip in foreign exchange reserves. According to official statistics in the 1st quarter of 2014 the net FDI in Belarus was $822m. This figure, however, is deceptive as it was likely the result of money being reinvested in the economy. In other words, there was likely no new foreign capital investment into the Belarusian economy.

However, it appears that the authorities will be able to sand off the rough edges of the current economic situation. In the beginning of May it was reported that Russia will provide a loan in order to help Belarus maintain its foreign reserves. Belarus expects to obtain the promised funds in May. The expected sum to be transferred is about $1.5bn, the remainder of a $2bn loan, that was approved by Russia at the end of last December.

Moreover, it looks like Russia’s decision to allocate the rest of the loan will be accompanied by a reduction of export duties on oil and oil-related goods. This welcome news means that Belarus may acquire a significant sum of money through reselling the oil, though it does not come without a hitch. Russia is planning on introducing a new tax for mining operations that will raise the costs associated with delievering oil to Belarus and will mitigate the benefits that Belarus had hoped to gain through reduced export duties.

One possible reason for the generosity and pliability of Russia is to ensure that Belarus will sign the agreement on the formation of Eurasian Economic Union after negotiations felt flat in Minsk at the end of April. Nevertheless, obtaining these funds will allow the Belarusian ruble to sit at a stable level and postpone any threats of its devaluation. Taking into account that presidential elections will occur in 2015, the authorities are doing their best to prevent Belarus from facing any severe economic shocks.

Maryia Akulava, Belarusian Economic Research and Outreach Center (BEROC)

This article is a part of a joint project between Belarus Digest and Belarusian Economic Research and Outreach Center (BEROC)