Belarus Seeks Money to Serve Its Mounting External Debt

Today a Belarusian delegation which included the Minister of Finance of Belarus Andrey Kharkavets and the Minister of Economy Mikalai Snapkou arrives for a three-day visit to Singapore and Hong Kong. They plan to arrange a road show to market the new Eurobonds issue of Belarus. They need to issue more bonds to service the growing national debt.

In 2013-2014 the amounts that Belarus will have to serve its external debt is likely to increase significantly. The country has borrowed this primarily to support of foreign balance figures. Now it steady keeps monthly deficit after the scandal with Russia on the solvents import. The need to repay the mounting external government debt puts the authorities in a rather difficult situation.

The resources required for payment of the external debt in 2013 are twice as much as it was last year and amounts to $3 billion. It seems that the Ministry of Finance wants to deal with primarily with current payments and delay the final resolution of the problem.

Source: Belapan

Who Belarus Owes To and For What

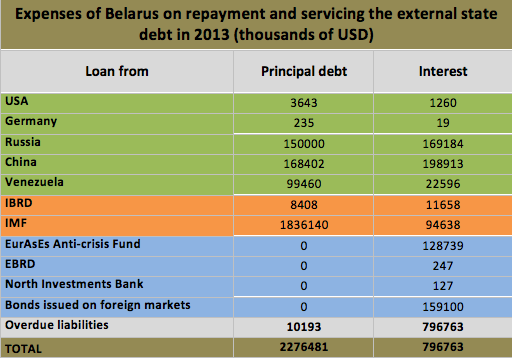

The creditor countries to whom Belarus will have to pay about $814 mln are the United States, Germany, Russia, China and Venezuela.

The bulk of these liabilities comes from the Russian loan received for construction of atomic power station. A German loan has helped the Belarusian State University to build the facilities of the faculty of foreign relations. Debts to the Chinese enabled different state ministries to implement a couple of investment projects. In its turn a loan from the USA has been spend for the purchase of cereals and grain. And finally the main reason why Belarus has applied for the financial help to Venezuela was the need to improve the foreign balance figures.

However, the bulk of external payments falls on covering loans received from international financial agencies: International Bank for Reconstruction and Development and International Monetary Fund – about $1,9 bln. The IBRD’s loan has supported the Belarusian government in funding and implementation social and modernization budgetary projects. The authorities has received an IMF loan for support of balance of payments and introduction of economic reforms, which in actual fact haven’t took place.

A special, less significant part of indebtedness consists of loans from other organisations and institutes and also interest on state-issued securities.

External debt is a considerable price which Belarus should pay for the inability to run the economy efficiently. Furthermore the expenses required for service of external loans in 2013 are greater than such budget items as the expenses for national defence or education.

Where to Find More Money

To relieve its debt load Belarus intends to attract new foreign loans in the amount of about $1,5 bln in 2013. The experts believe that country will be able to repay the other half of the debt using its own funds, but only in case it will manage to balance its foreign trade.

On 2 November, The Minister of Finance of Belarus Andrey Kharkavets expressed the same opinion at the meeting of the House of Representative: “We are looking for possibilities to cope with these payments … we are planning to finish the next year with a surplus in balance of trade.”

Therefore, the Ministry of Finance is planning to attract the resources of EurAsES Anti-crisis Fund – $0,9 bln, and issue new Eurobonds – $0,6 bln.

It should be noted that one of the EurAsES’s loan condition is annual privatisation of state assets in the amount of no less than $2,5 bln. According to analysts, currently Belarus is not prepared for large-scale privatisation projects. The explanatory note to the new budget proves it: "The most significant and at the same time the most difficult for implementation among the means of foreign liabilities’ funding is the sale of the state property to foreign investors”. That is why EurAsES’s loan may to a large extent depend on the political mood of Russia.

On the other hand the authorities officially announce that "on behalf of the President the Government has removed all restrictions related to the privatisation of state property". This statement Mikhail Myasnikovich made at the Belarusian Investment Forum on 15 November. The Prime Minister also noted that the country have not fulfilled the plan for income from privatisation this year. Also the official promised that the story of Spartak and Komunarka will not happen to any other Belarusian company.

The issuance of Eurobonds is a rather expensive way to finance foreign debt, but the MF supports it. On 29 October, the Chief of the IMF Mission in Belarus David Hoffman claimed: “We would support such borrowing in the short term”. However the expert emphasised, that the government should take care of the lowest price of this entertainment.

The main advantage of bonds is that apart from payment of interest they do not require fulfilment of other conditions on the part of the borrower, unlike, for instance, EurAsES loan. However, even more useful government bonds will not make a perfect way of the current debt refinancing.

Althernatives

At the same time the authorities try to find the alternative loans on the national market issuing the three-year government bonds at 7,5% warrant. According to the Deputy Minister of Finance Maksim Yermalovich the sale of government bonds on the national market will be continued. Moreover physical parties will also be entitled to purchase such securities.

Obviously, the best alternative for the country could be IMF’s loan resources which the government can borrow at the rate of 2-3% per annum. However, in such case Belarus will have to present a modernization program the implementation of which the Fund would agree to finance. According to the latest press-release of the IMF Mission in Belarus, ones of the key directions of change should be privatisation of state enterprises and limitation of subsidising various state programmes.

It is very difficult to imagine that Belarus will refuse to finance government programmes, which still remain the “backbone” of the country's economy. On the other hand the authorities probably will not agree or rather will be unable to launch privatisation in the way the found suggests it. An offstage but still necessary measure in case of crediting will likely be the demand to release political prisoners. The prisoners may become a tool in hands of Belarusian regime during the negotiations over financial aid.

What will happen

Therefore, two possible scenarios may be proposed.

The least likely one is that Belarus will not receive a loan from EurAsES and will not be able to significantly fill the hollow $0,9 bln large with other borrowed resources. In such case one should expect another crisis with escalation of inflation and serious fall in the rate of the national currency.

The most likely option is, however, that the country will receive the planned loans and issue bonds on both national and foreign markets. Thus, the current cheaper loan will be substituted by a more expensive one subject to the option of further repayment. One can only hope that the government of Belarus will reconsider its economic policy in the meantime. That could not only make the economy more efficient, but also enable the government to get "cheap" money from the IMF.

Zhenia Tsikhanovich