Belarusian Economy Creeping into Recession

The first quarter of 2015 displayed a number of distressing trends in Belarusian economy.

The adjustment of the exchange rate has not secured the restoration of competitiveness. Furthermore, the government has to resort to conservative policies for mitigating structural weaknesses.

The economy...

photo: bdg.by

The first quarter of 2015 displayed a number of distressing trends in Belarusian economy.

The adjustment of the exchange rate has not secured the restoration of competitiveness. Furthermore, the government has to resort to conservative policies for mitigating structural weaknesses.

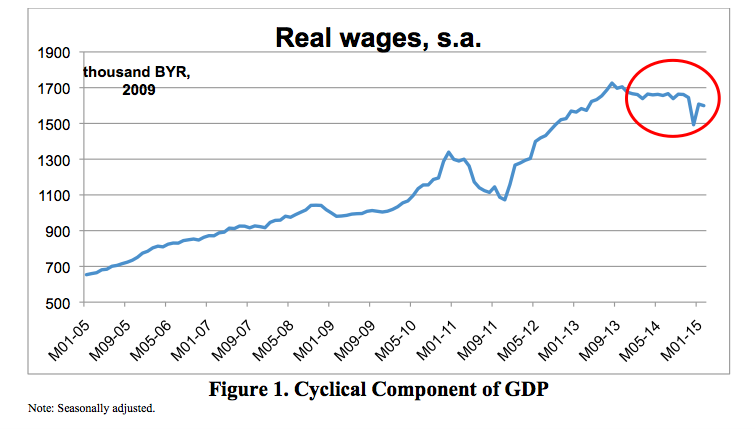

The economy has gone into recession, which was accompanied by lower real wages and levels of employment. However, a tough environment may become a trigger for structural reforms.

A New Economic Pattern: Shrinking Economy and Conservative Policies

The first quarter of 2015 has been distinct because of some of the novelties witnessed in economic dynamics and policies. A couple of months ago, the low competitiveness of Belarusian goods had become a key reason for the exchange rate's adjustment. But this time around, the authorities have minimised the impact of devaluation, as they were afraid of a new full-fledged financial crisis.

Hence, they have been deferring to ‘austerity policies’ to mitigate structural weaknesses and to restore competitiveness. Such policies include constraints on wages, fiscal expenditures, and a rather conservative monetary policy.

This scenario has changed the traditional landscape. First, the government has thus far refused to engage in a policy of wage stimulation. More than this, the government has actually begun to restrain wages, for instance, like those found in budgetary sector, and through administrative measures. Hence, a trend of real wage contraction has become persistent.

Second, a new reality has expressed itself through declining levels of employment and growing unemployment. Official statistics only report registered unemployment. In the 1st quarter it grew by 8.6%, reaching 0.9% of labor force. However, the absolute value of official unemployment is rather far from the actual figure. But, its growth rate may be used as a proxy for showing actual unemployment. Given the assessments of the latter at around 4.5% in December, one may argue that currently, the actual rate of unemployment tends is climbing towards its historical maximum from the last decade.

The new environment has resulted in a contraction in economic output. In the 1st quarter GDP fell 2%. The scope of this contraction seems to be relatively modest, as the depressed environment has also led to a tremendous contraction in imports. However, a mitigating recession due to fewer imports might be exhaustible: roughly all of the options for import restrictions have already been invoked. Hence, the additional competitiveness of enhancing the policies employed are necessary in order to ensure that the recession will continue to be modest and/or short-lived.

Sustainable Weaknesses May Secure Long-Lasting Recession

During the 1st quarter, Belarusian exports saw a significant decline. However, the adjustments in the exchange rate for the Belarusian ruble and the ‘austerity policies’ in place helped to mitigate this trend. Being accompanied by rapidly contracting imports, it helped to secure rather attractive foreign trade statistics.

For instance, the trade balance (goods and services) in January-February turned was in the green. From the perspective of current accounts, this means that it is likely to shift upwards into the positive in the first quarter as well (especially, taking into account that oil duties are going to the Belarusian budget this year, while previously they were being sent to Russia).

Improvements in its external positioning assisted in stabilising the exchange rate. The latter pushed the households to deposit more actively in the Belarusian ruble as they try to take advantage of a period of high real interest rates. This, in turn, created an impulse to drive interest rates down on financial markets. The authorities have begun to argue about stability and Lukashenka has characterised it as ‘a certain equilibrium between the economy and finance’.

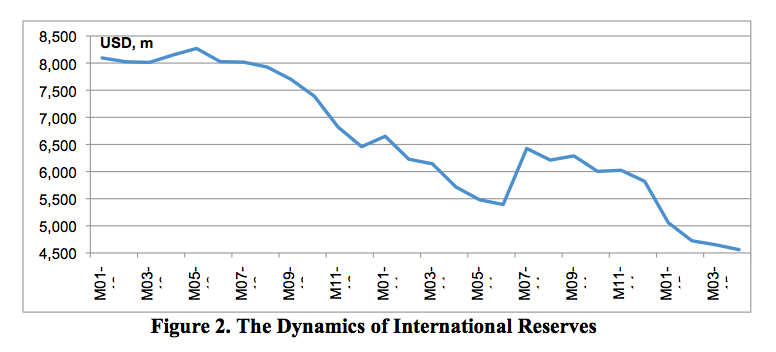

But in a broader context, the situation remains far ideal. First of all, despite improvements in foreign trade, international reserves continue to shrink (see Figure 2).

Payments towards external debts are the main culprit behind this development. Moreover, future payments due this year will lead to a further decrease of the reserves, unless some of the debts are not be refinanced.

Second, devaluation and inflation expectations are still high and not sustainable. Hence, any serious shock may generate a new wave of disturbances on domestic financial markets. From this perspective, dwindling reserves is alarming, as just it may trigger new financial turmoil.

Third, while the current policies have improved the competitiveness of the firms somehow, but the situation is still far from normal. A majority of firms still cannot restore their financial position because a huge part of their working capital is frozen in the pipeline. For instance, manufacturing firms have accumulated 84% of their monthly average production as finished goods inventories.

These frozen inventories can simultaneously cause a number of other events to unfold. First, the share of borrowed funds (bank loans) in firms’ working capital is increasing, substituting their frozen funds. Given the high interest rates, these will only worsen firms’ financial positions. Second, the lack of liquid assets influences the growth of non-payment in the real sector. Third, firms have to restrict their output, make further cuts in wages, which generate negative impulses for output patterns. Hence, the overall lack of competitiveness is likely to make the current recession deeper and more prolonged.

Authorities Apply for New Credit, Promising Structural Reforms

The authorities suffer from a lack of available instruments to smooth over the recession and reduce its potential length. Hence, their search for a new chunk of external financial support has once more become their primary target to solve the issue. In March and April they launched negotiations with Russia, the EurAzEC anti-crisis fund and the IMF for new funds.

However, the government is trying to show (albeit indirectly and without issuing any official statements) that this time is different – they are not just applying for more credit, but they want to use these funds as a kind of umbrella for structural reforms. For instance, a visit by the Belarusian authorities to the IMF's Spring Meetings included a presentation on a structural reform ‘road map’ that had been developed in cooperation with the World Bank. This ‘road map’ contains a wide range of measures, which indeed could lead to systemic structural reforms, if it were to be implemented.

However, there are still doubts amongst the Belarusian public about the willingness and readiness of the authorities to start the reforms. Given their negative past experiences, many experts argue that the agenda for structural reforms is simply being used as a justification for filling the state's coffers. It is up to the authorities to show what their real intentions are in the coming weeks and months.

Dzmitry Kruk

This article is a part of a joint project between Belarus Digest and the Belarusian Economic Research and Outreach Centre (BEROC)

Subbotnik With Top Officials, Opposition And The Presidential Elections – Belarus State TV Digest

"Dzielo Pryncypa" talk show

Did the Americans dismantle the Soviet Union? Did Belarusians benefit from the fall of the Soviet Union at all? These are some of the topics discussed by guests on the “Delo Principa” talk show on state-run ONT TV.

A recent subbotnik, a traditional voluntary (at least officially) clean-up day on Saturday, was a resounding success. State-owned TV focused its coverage voluntary work of officials in Hugo Chavez park. Around 3 million Belarusians participated in it and as a result over $4 million will find its way into the state budget. The head of state along with other officials, like millions of ordinary Belarusians, picked up and laboured away.

All of this and more in this edition of State TV digest.

Economy

Will the decree against “social parasites” stimulate people to work? According to “Panorama" on Channel 1, the new bill requiring people without official jobs to pay a levy, actually aims to protect of the rights of those Belarusians who actually pay their taxes.

Journalists portray those who avoid paying taxes as being typically well educated, with their own housing and a job, but who nonetheless receive their salaries in an “envelope”. The new law will help the state fight this long-standing practise.

According to Belarusian TV, other countries employ similar practises against tax evaders. For example, in the US such people can be fined or even end up in prison. Belarus, it was argued, appears "more democratic" on this front and will require tax evaders to pay lower fines. The decree has already started bringing in results as more Belarusians have expressed their interest in looking for a job.

Is the Belarusian economy open and attractive? Standard & Poor’s has confirmed a long-term credit rating of B- for Belarus, according to “Panorama”. According to the coverage, much of this has to do with the "rational economic policies of the Belarusian authorities". In addition, they have managed to "adapt the economy to complicated external circumstances". The programme went so far as to say that the positive rating proves the "transparency and openness" of the Belarusian economy.

Politics

Does the Belarusian opposition support Lukashenka? Journalists from “Glavnyj Efir” on Channel 1 covered the upcoming presidential elections, reporting that a number of the opposition-minded organisations in Belarus have already declared that would not participate in the elections. For example, the “For Freedom” movement of Aliaksandr Milinkievich will not nominate a candidate from among its ranks. Another organisation “Nash Dom” led by Volha Karach will also not be participating. “Today’s alternative to Lukashenka is war, unemployment and collapse”, journalists cited a letter published by the “Nash Dom” leadership.

Belarusian president can take up a shovel ... in addition to the fact that he can play hockey, drive a car, or a motorcycle Read more

Lukashenka: No Room for Populism. “Glavny Efir” on Channel 1 covered the subbotnik, a traditional voluntary community work and clean up day that falls on Saturdays. This year it attracted rather diverse crowd, according to the coverage, ranging from a “school child to the president”. Alexander Lukashenka was working on the construction of a new children hospital in Minsk. But he also found time for a press conference.

“Everyone knows that the Belarusian president can take up a shovel, or any other instrument for construction in his hands, in addition to the fact that he can play hockey, drive a car, or a motorcycle”, stated one journalist, flattering the head of state. Lukashenka explained he "does nothing just for show, but rather tends to do things which he does in real life".

Subbotnik: All (officials) hands on board! Other senior officials also took part in some volunteering. Andrej Kabiakau, Prime Minister, planted pine trees. Aliaksandr Kosiniec, the head of the Presidential Administration, helped out with building a new school in Minsk. Mikhail Miasnikovych, chairman of the Council of Republic, also helped out with a construction project. Uladzimir Andrejchanka with other MPs tended Hugo Chavez Park in Minsk. As a result of the subbotnik nearly 61 bln BYR (over $4m) will be saved. The authorities will spend the money on equipment for Belarusian hospitals, festivities for the the Great Patriotic War celebration and modernising sanatoriums in Belarus.

Perestroika and Belarus

On his talk show “Delo Pryncypa” on ONT TV, Vadzim Hihin discussed the results of perestroika in the Soviet Union for Belarusians. Among the guest speakers were Valentin Holubieu (former opposition MP from 1990-1995), Valentina Leonienka (Secretary of the Communist Party and MP), Aliaksandr Shpakouski (the head of the information centre "Aktualnaja Kancepcyja"). Participants discussed the reasons behind the fall of the Soviet Union, but also its consequences for Belarusians.

Charhyniec forcefully argued that the Americans stood behind the collapse of the Soviet Union Read more

Did the Soviet Union have to be reformed? “The Soviet system was rotten” according to Valery Karbalevych, a political scientist. Mikalaj Charhyniec, the head of the Association of Writers of Belarus, strongly disagreed with Karbalevych and pointed out that the Soviet Union was a worldwide leader in education, but also its citizens were highly motivated to work. Juriy Zisser, the founder of the popular Belarus news portal tut.by, noted that the Union bankrupted itself politically and economically.

Did the Americans dismantle the Soviet Union? Mikalaj Charhyniec forcefully argued that the Americans stood behind the collapse of the Soviet Union. During the talk show it turned out that 65% of people gathered in a studio supported Aliaksandr Shpakouski who stated that there was an operation by American special service aimed at the destruction of the Soviet Union.

Any benefits from the fall of the Soviet Union for Belarusians? Valery Karbalevych, Aliaksandr Shpakouski, Valentin Holubieu agreed that the demise of the Soviet Union had fortunately led to the creation of a sovereign Belarus. Some of the guest speakers pointed out that with respect to culture and education Belarus had actually suffered as a result of the fall of the Soviet system.

At the end of the talk show Vadzim Hihin presented the results of a telephone vote: only 15% of people assessed perestroika positively, whereas 85% of voters negatively.

Belarus Digest prepared this overview on the basis of materials available on the web site of Belarusian State Television 1 (BT1) and ONT TV. Freedom of the press in Belarus remains restricted and state media convey primarily the point of view of the Belarusian authorities. This review attempts to give the English-speaking audience a better understanding of how Belarusian state media shape public opinion in the country.