Belarus’s plan to import Iranian and Azerbaijani oil: how serious is Minsk?

Belarus Council of the Republic Speaker M. Myasnikovich and Iranian Parliament Speaker A. Larijani, Tehran, 6 February 2017. Image: IRNA

On 3 April, Belarusian president Alexander Lukashenka succeeded in securing concessions from Vladimir Putin following a year-long oil and gas dispute between the two countries. In order to reach a deal, Minsk put the idea of buying oil from non-Russian sources back on the table.

On 15 February, the news source Reuters reported an oil deal between Belarus and Iran. It involved 80,000 tones of Iranian oil which were indeed delivered on 24 March to the Ukrainian port of Odessa for subsequent transport to Belarus.

Over the past decade, Minsk has already gained more experience than its neighbours in securing alternative oil sources; it has been able to secure both Venezuelan and Azerbaijani oil before. Although the deals were short-lived, the Kremlin's reaction to these manoeuvres proves that it takes the Belarusian government's efforts seriously.

Oil from non-Russian sources: Has Minsk reported only a fraction of its imports?

Both Belarus and Iran released minimal information regarding their February oil deal. All publications made reference to Reuters, adding only cursory commentary. Even the National Iranian Oil Company (NIOC), the seller of the oil, based its press release on the Reuters report.

This is in line with the policy of the Belarusian government to shun publicity in its efforts at diversification. According to Reuters, in 2016 Belarus imported a total of 560,000 tones of Azerbaijani oil, but these deliveries stopped in January 2017. Only a handful of these deliveries – just 84,000 tones – were reported in the media before Reuters published its report on 15 February.

This is in line with the policy of the Belarusian government to shun publicity in its efforts at diversification. According to Reuters, in 2016 Belarus imported a total of 560,000 tones of Azerbaijani oil, but these deliveries stopped in January 2017. Only a handful of these deliveries – just 84,000 tones – were reported in the media before Reuters published its report on 15 February.

Poland's shadow

Remarkably, it was Beloil Polska, the Polish subsidiary of the Belarusian Oil Company Belarusneft, which closed the deal on the Belarusian side. On 20 February, Polish security and energy expert Piotr Maciążek wrote a piece for the well-informed Energetyka24 web outlet suggesting that Belarus was buying Iranian oil with Polish assistance.

He argued that Belarus's deal with Iran on oil delivery could have been linked to another deal regarding Iranian oil supplies to Poland. To conclude its agreement agreement with Tehran, Minsk may even have used the direct support of Warsaw, which is rapidly developing relations with Iran. The fact that the very same NIOC press release about the oil deal with Belarus made reference to an Iranian oil delivery to Poland supports this hypothesis.

There are good reasons to believe that Minsk's move to buy Iranian oil is politically motived by the need to counter Russian pressure. After all, Minsk reportedly purchased only 80,000 tones from Iran, and the deal was completed as a spot transaction; it involved no longer-term commitments.

Most commentators also believe that this oil is to be transported by rail; if Minsk planned to import larger volumes of Iranian oil on a more regular basis, it would make more sense to use Ukrainian pipelines.

Most commentators also believe that this oil is to be transported by rail; if Minsk planned to import larger volumes of Iranian oil on a more regular basis, it would make more sense to use Ukrainian pipelines.

However, two facts indicate that Belarus most likely plans to import oil via Ukrainian pipelines in the future. In November 2016, Ukrainian minister for regional development Hennadi Zubko reported that Ukraine would possibly be transporting Azerbaijani and Iranian oil to Belarusian refineries. Moreover, on 21 March, the Ukrainian pipeline operator Ukrtransnafta announced the re-opening of an oil pipeline between Belarus and Ukraine.

Belarus's former plan to import a third of its oil from non-Russian sources

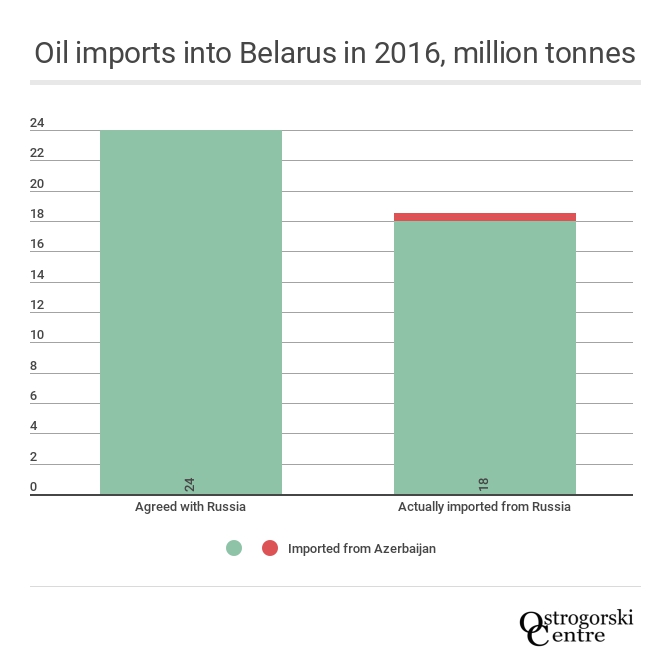

By buying oil from Iran and Azerbaijan, Minsk is reacting to the Kremlin's attempts to impose its own terms of economic cooperation and integration on Belarus. After the beginning of the latest gas dispute between Minsk and Moscow, in 2016 the Kremlin reduced its oil exports to Belarus from the formerly agreed 24m tones to 18m tones.

Oil refinement and sales of reprocessed oil products constitute a major source of income for the Belarusian government, so the reduction of supplies dealt a blow to the financial situation in Minsk.

On 3 April, Belarusian Economy Minister Uladzimir Zinouski directly linked the contraction of the Belarusian GDP in January-March to the reduction of Russian oil imports. Belarusian refineries received less oil, and thus produced less oil products for export.

On 3 April, Belarusian Economy Minister Uladzimir Zinouski directly linked the contraction of the Belarusian GDP in January-March to the reduction of Russian oil imports. Belarusian refineries received less oil, and thus produced less oil products for export.

This, however, is not a new problem for the Belarusian leadership. In 2010, Minsk faced similar problems securing enough Russian oil on favourable terms, so Lukashenka made an oil deal with Venezuela. Belarus, however, is a landlocked country dependent on its neighbours – primarily the Baltic states and Ukraine – for access to the sea, by which the oil must be transported.

In July 2010, the Belarusian government signed an agreement with Ukraine on use of the Odessa-Brody pipeline to transport oil from the Ukrainian Black Sea port of Odessa to Belarus. Minsk guaranteed it would pump through Ukrainian pipelines at least 4m tones yearly in 2011-2012, and even hinted at the possible extension of the agreement after 2012, with the oil volume increasing to 8m tones.

At the same time, Minsk was negotiating with the Lithuanian port of Klaipeda over the possible transport of 2m tones of non-Russian oil yearly on a long-term basis. There were similar negotiations with Latvia and Estonia. Oil deliveries also took place via the three Baltic states subsequently.

As long as Belarus planned on buying Venezuelan oil, schemes involving millions of tones seemed fanciful. Very soon, however, Lukashenka managed to convince Azerbaijan to join the Belarusian-Venezuelan oil deal through swap contracts. Thus, in place of direct deliveries from Venezuela, since 2011 Belarus has been receiving Azerbaijani oil.

Under these circumstances, receiving 4m tones a year seemed like less of a fantastic target, although in total Minsk received only one million tones via the Ukrainian pipeline in 2011– about five per cent of what it needed.

How Lukashenka prevailed over the Kremlin

Naturally, Moscow was irked by Minsk's plans, which were becoming reality. In the end, however, the Kremlin's hands were tied and it eventually gave in: by the end of 2011, Minsk had succeeded in getting Russian companies to sign oil agreements more or less on the terms the Belarusian government had wished. Belarus then stopped importing non-Russian oil until 2016.

Naturally, Moscow was irked by Minsk's plans, which were becoming reality. In the end, however, the Kremlin's hands were tied and it eventually gave in: by the end of 2011, Minsk had succeeded in getting Russian companies to sign oil agreements more or less on the terms the Belarusian government had wished. Belarus then stopped importing non-Russian oil until 2016.

This history certainly raises questions about the seriousness of Minsk's intentions to diversify its energy sources. This is as true now as it was in the early 2010s. Nevertheless, the scale of the commitments and risks the Belarusian government was prepared to take vis-a-vis Moscow and Kyiv in 2011 in order to import non-Russian oil proves that Minsk is ready and willing to diversify should Russia prove intractable.

At present, Minsk's moves towards diversifying its energy sources seem more modest. But they could turn out to be larger than currently thought: some deliveries could remain unreported, as the post factum revealed data about the volumes of 2016 imports of Azerbaijani oil prove. Last but not least, in either scenario Moscow has capitulated: the Kremlin seems to be taking Minsk's diversification efforts seriously.

Response from Russia to Belarusian political change to shape Russian-Western relations

Response from Russia to Belarusian political change to shape Russian-Western relations