Since the 2020 political crisis began in Belarus, the EU, the UK, and the US enacted targeted sanctions against Belarusian officials and government-linked businesses. These sanctions did not aim at the economy as a whole. Experts did not expect...

In the fifth round of EU sanctions adopted in response to Putin’s invasion of Ukraine, the union prohibited freight transport on member state territory by Russian and Belarusian carriers from 16 April. Alongside the EU prohibitions on flights and...

On 12–13 April 2022, Alexander Lukashenka paid a working visit to Russia’s Far East. This was his third trip to the neighbouring country this year. According to Russian media, talks taking place between Lukashenka and Russian President Vladimir Putin...

On 26 October, prominent Chinese government expert on post-Soviet states Wang Xiaoquan warned that an escalation of Western sanctions against Belarus could disrupt China-EU transit routes. Paradoxically, Belarusian President Alexander Lukashenka needs to improve relations with the EU in...

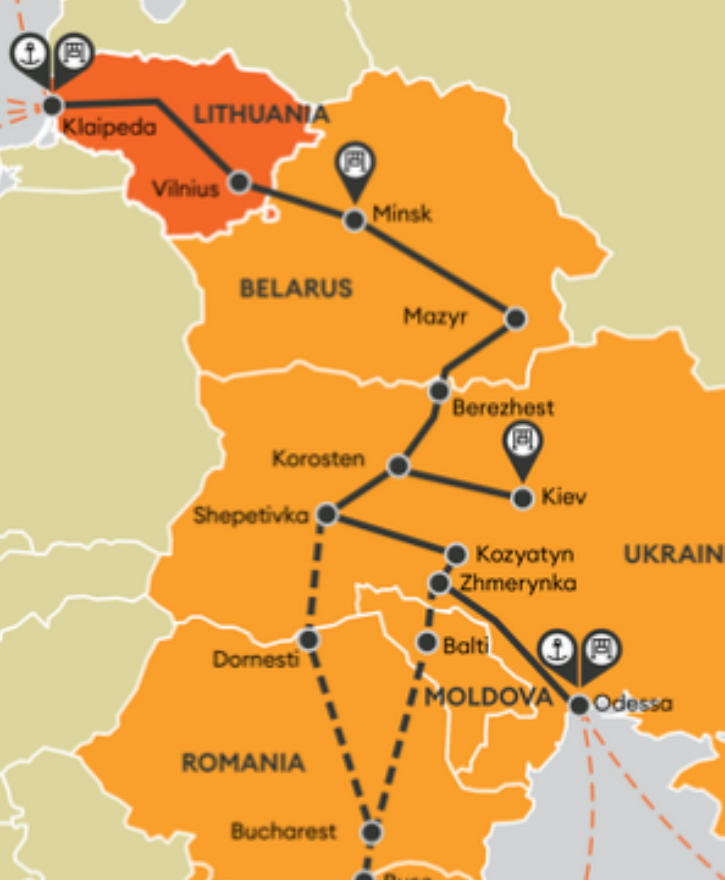

For more than a month, Alexander Lukashenka has been threatening to stop exporting Belarusian goods via Baltic states’ ports, and to halt their transit via the Baltics and Poland. Alongside other measures taken by him, such as in the...

The breach of trust in the government since the disputed 9 August presidential election has already cost the Belarusian economy a lot. People are withdrawing deposits from banks, large manufacturing enterprises are going on strike, and IT companies are...

Speaking at a conference on 28 August, Belarusian President Alexander Lukashenka announced that he was willing to enter into dialogue with “working and student collectives” on political issues, including to prepare a new constitution. While he has a poor...

On 12 April, tut.by reported that Belarus has pushed for an urgent modernization of it chief refineries in Navapolatsk and Mazyr to minimize the losses from the reduction of Russian oil dotations via the ‘tax manoeuvre’. However, if Russia reduces...

Since gaining independence, Belarus has never participated in proper investor-state disputes. Nevertheless, in late 2017 and 2018, Belarus faced a record-breaking three investment arbitration claims. A Dutch investor in a Belarusian financial institution and two Russian investors in the...

In August-October 2018, Belarus and Russia held difficult negotiations on duty-free supplies of crude oil and oil products for the remaining part of 2018 and for 2019. Russia insisted that in order to receive concessions in future, Belarus had...

Last month, in a speech to the Belarusian parliament, Alexander Lukashenka expressed dissatisfaction with Belarusian airlines. The president questioned the absence of low-cost flights in Belarus and Belarusians’ extensive use of Vilnius, Warsaw and Kiev airports. This issue –...

On 16 March 2018, the official statistical body of Belarus Belstat has announced that GDP growth in the first two month of the year has accelerated. Meantime, the weak regional development cast doubt on the sustainability of Belarusian economic...

On 6-8 April, Chinese defence minister Wei Fenghe will visit Belarus. Wei’s combined visit to Russia and Belarus, his first foreign trip since taking up the post, demonstrates recognition that Minsk gives the highest priority to its partnership with...

On 16 February 2018 Belstat, the official statistical body of Belarus, announced that GDP growth for the first month of the year had reached a new high, surpassing the previous month’s record. Meanwhile, the Heritage Foundation’s statement on 5 February...