Chinese FDI in Belarus: Investing in a Backwater?

Last week, a delegation led by Sinomach, the largest state-run machinery manufacturer in China, met with Economy Minister Nikolai Snopkov. This follows a visit by Wu Bangguo, head of China's National People’s Congress, to Minsk last month.

Beijing will issue a $1 bn soft loan to help Belarus out of its current account crisis. Minsk will reciprocate by granting China equity stakes and joint ventures in strategic sectors, such as machinery and power generation. This follows $15 bn in loans issued by Chinese banks to Belarus over the past two years.

These developments are emblematic of China’s global expansion. With foreign exchange reserves at half of GDP, China is looking to reinvest surplus capital overseas. Since 2009, it has poured more money into developing economies than the World Bank. In the process, Beijing is expanding diplomatic influence, securing resources and markets, and promoting the globalization of state-owned firms. Like other low-income countries, Belarus is eager to obtain Chinese capital and technology on preferential terms. But Belarus is unique in several respects.

China is entering just as the Belarusian economy faces severe challenges. China sympathizes with a post-socialist country ruled by a strong state. If China, as opposed to Russia or the EU, becomes Belarus’s major investor, this could have major implications for the country’s future. Belarus may also become a geostrategic node for China in Eastern Europe. This could trump the EU’s efforts to isolate Belarus, as well as challenge Russia’s attempts to control its smaller neighbor.

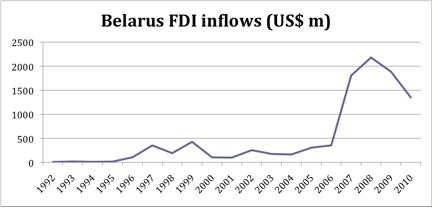

Historically, Belarus has not been a popular place to invest. In 2000-10, the average share of FDI to GDP was below the level for post-Soviet states, even though Belarus’s economy is very small. In the industrial sector, firms with foreign investment account for less than a tenth of total output and employment. China thus appears to be venturing into an investment backwater.

But conditions for foreign investors in Belarus are a lot better today than ten years ago. FDI inflows increased markedly in 2007, from less than one percent to four percent of GDP. Unlike exports, which plummeted after the crisis in 2009, FDI inflows have remained high.

FDI growth is likely to continue with or without the Chinese. Belarus is an extremely open economy, with trade volume at 101 percent of GDP in 2010. Theory and empirics dictate that foreign investment follows trade. More importantly, the government, in spite of excessive interference in the economy, has implemented measures to attract investment. In an April 2008 speech to the National Assembly, President Lukashenka announced the target of making Belarus one of the 30 countries with the best business climate. This is echoed in a report by the cabinet’s Foreign Investment Consultative Council, which also aims to increase FDI to one fifth of GDP in the next decade.

Even if Belarus does not meet these targets, its investor environment has certainly improved. Last year, it ranked 68th among 183 countries on the World Bank’s “Ease of Doing Business” survey, ahead of China and Russia. On several indicators, such as the time it takes to start a business and the cost of registering property and enforcing contracts, Belarus does better than average for post-Soviet states. It has also been one of the region’s most prolific signatories of bilateral investment treaties (BITs); the bulk of these have been with countries outside the region.

Nonetheless, investor-friendly policies are not useful without economic stability. Judging by Belarus's recent performance, Chinese investors will face considerable risks. The Belarusian ruble, on a crawling peg with a basket of currencies, has not withstood severe inflationary pressures. The first major devaluation came in January 2009, followed by several more this year. Due to excessive borrowing and plummeting exports, Minsk can no longer service its current account deficit. One could argue that the upside of a poor country fraught with debt, inflation, and currency risk is its growth potential – GDP did expand at eight percent per year in 2000-08. But in light of the current crisis, the IMF forecasts just four percent annual growth for 2011-16. In the meantime, the structural reforms necessary to improve the economy – such as more flexible labor markets, a smaller public sector, and less welfare spending – will take time.

The Chinese don’t seem too concerned though. During his visit, Wu Bangguo sought to shore up investor confidence by blaming Belarus’s misfortunes on Western sanctions and the global economy. His statement was politically motivated. Even when the global economy recovers, Belarus’s exports are unlikely to return to previous levels, because they are losing their principal advantage: subsidized oil and gas inputs from Russia.

Economic recovery may be less relevant for Chinese companies in Belarus. Because most are owned by the state, they face less pressure to make quick profits and can turn to state-owned banks for refinancing. As latecomers, the Chinese often leverage risk propensity to explore opportunities in markets that Western investors avoid. The question is: what opportunities does Belarus, a small country without natural resources, really offer?

From China’s perspective, there are plenty. Currently, the bulk of FDI is flowing into trade and services rather than manufacturing and infrastructure. As a result, FDI has countributed little to fixed capital formation. So Belarus is lacking FDI precisely in those areas where Chinese companies are strongest.

Much has been made of China’s bid to acquire state assets. But the Chinese are equally keen on forging new industries. During Wu Bangguo’s visit, Prime Minister Myasnikovich expressed interest in establishing an industrial park for Chinese firms, referring to the success of Singapore’s industrial parks in China. He might have mentioned that the Chinese now have ample experience with independent economic zones in developing countries, such as Pakistan and Zambia. Implicit in Myasnikovich’s comment was also disappointment in Belarus’s own Free Economic Zones (FEZs) – established in the 1990s, they have failed to attract notable investments.

In sum, Chinese firms see opportunities and downgrade risks. Chinese investment is likely to increase in the medium term, through good times and bad. Whether and how Chinese investors will benefit Belarus, however, is another matter.

Iacob Koch-Weser, contributing writer

(This is the first article of a three-part series)