External and Domestic Shocks – Digest of Belarusian Economy

In July, GDP growth somehow gained momentum, but was still very modest and difficult to place confidence in. Shrinking external demand is one of the core problems for the national economy, although the authorities attempt to compensate these losses of output through stimulating domestic demand.

But this mixture of policies is becoming more and more dangerous, as it leads to a rapidly growing external deficit that is unsustainable due to the absence of resources to maintain its financing. The result has been a surge in pressure in the foreign exchange market.

The authorities are afraid of making macroeconomic adjustment based on exchange rates as it may provoke a new wave of uncontrolled inflation-depreciation.

In July, they resorted to a number of monetary mechanisms to halt any major fluctuations and maintain a fragile equilibrium. From a short-term view, they have succeeded, but from a medium-term view, the problem has been postponed rather than solved.

GDP constantly growing

The Belarusian Statistical Committee Belstat reported that GDP growth rate in January-July was 1.4% year-on-year, i.e. it remained constant in comparison to the first half of 2013. According to our estimations, it means that in July the growth rate was somehow stronger when compared to April, May, and June. Growth, however, remains rather modest.

From the supply side, only a handful of industries displayed a growth in their output, and correspondingly, contributed to GDP growth positively: both the retailers and wholesale traders saw gains, as did construction. Other key industries of the economy – manufacturing, transport, communications, and agriculture – were still in recession.

On the demand side, household consumption still retained its position as a leading contributor to GDP growth. This was due to a perserved growth rate of real wages. For instance the growth of real wages (on a seasonally adjusted basis) in the 2nd quarter with respect to the 1st quarter amounted to 4.6%.

The intention of the government to maintain this growth is disturbing, because there are no sound reasons for it. Consider the fact that the return of a previous long-term trend after the crisis of 2011 has already occurred, which means that the further growth of the cost of a unit of labour will result in either a lower level of competitiveness and profitability of firms, or further monetary inflation pressure, or perhaps both.

In July, a sudden jump in the growth rate of capital investments took place: it grew by 18.4% year-on-year, which followed a relatively modest growth of 6.7% year-on-year in the second quarter. In a sense, July might be seen as a turning point in the government’s policy: having exhausted the potential for stimulating GDP growth based on real wages, it is likely to reorient itself to stimulating output through capital investments. To succeed it needs a space to manoeuvre in both its external and financial sectors. But the problem is that there are plenty of obstacles in both these areas.

The balance of internal trade deteriorates

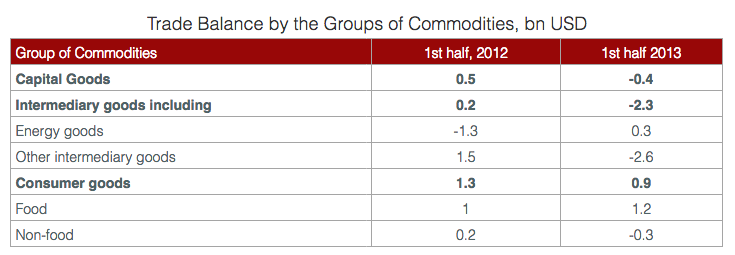

The balance of the foreign trade of merchandise deteriorated during the first half of 2013 and by the end of the same period with the trade deficit amounting to 1.7bn USD against the surplus of 1.9bn USD in the first half of 2012. Roughly a third of this trade balance deterioration is due to the impact of thinners and solvents schemes (which, thanks to them, exports flourished in the first half of 2012).

However, the deterioration of trade in other areas is of much more of concern, as the complete halt of thinners and solvents exports was only a single adverse shock to the economy, while the latter might be a long-lasting development and it is much harder to neutralise its impact on the economy.

Apart from the issues surrounding thinners and solvents, a number of additional reasons explain the deteriorating trading environment. First, Belarus has lost a substantial number of its advantages in price competitiveness that were inherited from the currency crisis of 2011: by the end of the first half of 2013 the real exchange rate appreciated by 53.7% in comparison to its low point in August 2011.

This means Belarusian producers became less competitive both in domestic and external markets.

Second, growth prospects in other countries, even with its trading partners (Russia first and foremost) worsened, which led to a contraction in the demand for Belarusian goods. Third, global trends aggravated trade conditions (i.e. the relationship between exports and imports prices) for Belarus. Fourth, domestic expansionary policy led to higher demand for imports by firms and households.

As the table demonstrates the first half of 2013, roughly all groups of commodities displayed a reverse trend in the direction of exports and imports in real terms on year-on-year basis (except energy goods). In other words, exports fell, while imports grew.

New loans or macroeconomic adjustment?

Given this pitiable external environment, the government is expected either to resort to securing new external loans, or to carry out a macroeconomic adjustment.

The problem with this is that not only are there hardly any available or affordable sources from which they could secure loans, the authorities are also reluctant to carry out any macroeconomic adjustment. Currently the government has resorted to its only alternative – spending its international reserves – but this option is of limited usage, whether one considers it from the perspective of the how long it can be done and the value of its reserves, or from the perspective of how dangerous the issue of credibility of such an economic policy is.

In late July and August, a new external shock occurred. The Russian producer of potash fertilisers Uralkali decided to abandon an agreement with Belaruskali on joint sales. The coordination of their sales policy enabled the companies to be the main players in the global potash market and affect the dynamics of world prices. However, Uralkali stated that it would be going to change its strategy and would resort to the strategy of maximising its output.

If this is the case, global prices will definitely go down, but the scope of such a decrease is questionable. The most radical scenario assumes a double reduction in global prices. For Belarus, this scenario will lead to a loss of export revenues of about 1.5bn USD, i.e. an increase of the trade deficit by roughly 2% of GDP.

Financial Dollarisation

Given the drastic deterioration of the external environment surrounding the economy, one would expect the authorities to carry out macroeconomic adjustment. An adjustment based on exchange rates seems to be the most natural and least painful in this case. In July, there were some signs of readiness on the part of the authorities to this approach and the nominal exchange rates began to depreciate.

However, soon thereafter the authorities decided to prevent a rapid exchange rate adjustment, because many households began to withdraw their deposits in their national currency and convert them into hard currency. This problem is a chronic one for Belarus and many households traditionally react through deposit dollarisation (i.e. change their deposits from the national currency to a foreign currency) to even small fluctuations of the exchange rates, which causes further fluctuations in the financial markets.

Ultimately, financial dollarisation hints at a problem of a higher order – the lack of credibility of the government’s monetary policy (and its economic policy as a whole). However, the authorities lack the capacity to battle with this fundamental problem and have to struggle against a ‘symptom of decline’, i.e. deposit dollarisation.

Hence, they use the instruments of monetary policy in order to maintain fragile stability at the foreign exchange market. In July, monetary policy authorities reduced their money supply and facilitated a liquidity shortage in the money market. A jump in interest rates in the national currency was the main outcome of this policy, which ultimately stopped the outflow of deposits in the national currency from banks and mitigated the pressure in the foreign exchange market.

These actions, however, seem to be effective in postponing the problem, rather than solving it, as this volatile mixture of policies has nothing to do the progressively growing external trade deficits.

Dzmitry Kruk, Belarusian Economic Research and Outreach Center (BEROC)

This article is a part of a joint project between Belarus Digest and Belarusian Economic Research and Outreach Center (BEROC)