Need For External Financing and Ambiguous Business Perspectives – November Digest of Belarus Economy

This November showed the need for foreign capital in the Belarusian economy is becoming more and more acute.

By the end of October the international reserves of Belarus decreased by $575m and amounted to $6.813bn. This number is much lower than the $8,500 predicted by the authorities in the beginning of 2013 and makes the problem of attracting capital all the more severe.

At the same time likely changes in the regulation of individual entrepreneurship will create additional pressure on the sector and may negatively impact the business environment of the country. Finally, opposed evaluations of the economic situation exist within the country.

While authorities officially tend to have an optimistic assessment of the situation, the banking and real sector show a rather uncertain attitude.

Reluctant attempt to activate privatisation process

The unsatisfactory results with the volume of international reserves fostered activities of authorities in terms of the privatisation of state assets. At present, it can be stated that Belarus missed out on the privatisation process in 2012, with just a few sales of state assets occurring last year.

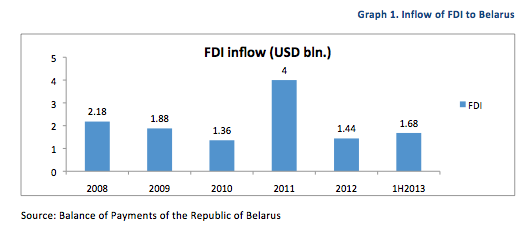

Belarus is peculiar in its ability to attract foreign capital at a rather steady level throughout the years (Graph 1). However, this capital mostly comes in the form of reinvested earnings and not sources obtained because of privatisation.

Therefore, the State Property Committee created a list of 80 open joint-stock companies, the selling of which will bring around USD 4.5bn into the state budget. For their part, the EurAzEC Anti-Crisis Fund is evaluating the readiness of the Belarusian economy for massive privatisation. This evaluation will impact the decision to be made by the Fund on whether or not to provide the 6th tranche of a EurAzEC loan at amount of USD 440m.

Another sign of possible revitalisation of the privatisation process and the readiness of authorities to get rid of state property is the administrative transfer of state enterprises from privately owned telecom operator OJSC “Velcom” to OJSC “MTS”, which the state controls 50% of its shares. The reason for this transfer from state to private hands is still unclear. However, it could potentially help the state to sell its shares in “MTS”, which the authorities have been trying to do over the last 4 years.

Until now the main problem consisted in finding a compromise on the price. Belarus planned to get around USD 1bn from that sale. However, the maximum price from investor offered was around USD 600-700m, and this occurred before the crisis hit the Belarusian economy in 2011.

This action will likely have a positive impact on the successful sale of the state's shares. The transfer of state enterprises from one telecom to another will increase the client base of the state asset in the latter. Moreover, the corporate segment of a client base always brings in a large portion of a companies’ revenue. The increase of this segment will raise the estimated real value of the company and help Belarus sell it for the maximum possible price.

Nervousness in the entrepreneurial sector

The forthcoming highly likely implementation of new technical regulations, that oblige entrepreneurs to certify light industry produced goods, is an issue of great concern for individual entrepreneurs due to the fact that this novelty will negatively impact business performance as a result of the expensiveness and length of the procedure to receive certification.

These regulations will possibly come into force by 1 January 2014. Thereafter entrepreneurs will have either to provide the required documentation, which is unlikely, or go through certification procedure, which will bring additional costs for them to do business.

It should be mentioned that during the meeting of subcommittees of Eurasian Economic Commission in August 2013 it became clear that these technical regulations apply only to importers and producers, and not entrepreneurs involved in retail trade. However, it looks like the authorities unreasonably expanded the scope of appliance of technical regulations all on their own.

As a result, entrepreneurs reacted to this situation in the form of a declaration of their unwillingness to work under these circumstances, an action, that if it were to be carried out, is very undesirable for the weak economy.

Ambiguous perception of the economic situation

At the end of October the Ministry of Economy repeatedly revised its estimations of GDP growth towards a more and more optimistic scenario and changed the number from 2.4 to 3.3 percent. The officials explained that these changes occurred due to adjustments in foreign trade and an expectation to end up with a surplus in the country's trade balance.

They relied on additional sales of potash, coupled with the growth of exports of meat and automobile industries. These optimistic expectations regarding the exports of potash fertilisers raise certain concerns because of the ongoing conflict with Uralkali and the decreased price of potash on the world market.

On the other hand, very different views on the situation are present in the banking and real sector. In the beginning of November the last state bank stopped issuing loans for purchasing housing. Thus, there is only one commercial bank left in the market and it provides loans with 55% interest rates. Uncertainty in the market appears to be the main reason for suspending lending, and forces banks to hold out until interest rates become stable.

This indicates that the current tendencies remain unsatisfactory for the banking sector and raises concern regarding the latest developments. As for the real sector, the results of the latest monitoring of enterprises, conducted by the National Bank, showed that the enterprises evaluate their economic situation as more pessimistic when compared with similar evaluations a year ago.

According to the survey, the real sector deteriorated due to lending conditions and the volatility of the currency exchange rate explain such a negative trend. Nearly all respondents expect a significant slowdown in the growth of the physical volume of production due to uncertain economic situation.

Maryia Akulava, Belarusian Economic Research and Outreach Center (BEROC)

This article is a part of a joint project between Belarus Digest and Belarusian Economic Research and Outreach Center (BEROC)