One Step Forward, Two Steps Back: Digest of Belarus Economy

The drop in oil prices in the first two weeks of January and the resulting volatility of the Belarusian rouble have taken centre stage.

The Belarusian government took some small steps towards reforms, but took no serious measures to reform the state-owned sector of the economy.

Instead, it continued to pump money into inefficient enterprises to keep them afloat. Meanwhile, trust in the Belarusian rouble and the banking system is declining, leading to significant deposits outflows.

Oil turmoil hits the Belarusian rouble

Despite the presence of much depressing economic news in January (such as the 3.9 per cent decline in GDP growth in 2015, or the small traders strike), the adventures of the exchange rate of the Belarusian rouble were making the headlines. From 1 January to 31 January 2016 the Belarusian rouble lost 12 per cent of its value against US dollar, as the exchange rate changed from BYR18, 569: $1 to BYR20, 823: $1.

The exchange rate reacted to the drop in oil prices, which affects Belarus in several ways. First of all, the Belarusian economy, in particular the exports, depends greatly on the Russian market and the exchange rate of the Russian rouble, which in turn is reacting to the oil price. Second, Belarusian oil refineries make greater profits the higher the price of oil, and there are similar consequences for tax collection.

The current Belarusian budget is based on a forecast average price of Brent oil at $50 in 2016. Prices in the first month of the year made clear that the government needs to revise the forecast down, and cut the expenditures it had planned.

The behaviour of the exchange rate in the next months will largely depend on the oil price fluctuation, and the Belarusian rouble might even appreciate if the oil price goes up. But given the uncertainty on the oil market, and complete inability of the National Bank (central bank) to stabilize the exchange rate fluctuations since the currency reserves are low, the rouble may see a lot of volatility in the future.

Reforms: two steps forward, one step back

In January the government took several important steps towards reform. As expected, the government started implementing IMF-recommended reforms with unpopular subsidy cuts. On January 1 heating tariffs increased substantially, along with increases in other utilities tariffs,and a VAT tax on utilities was introduced.

At the end of January the government announced that it was working on providing targeted support to those who will have difficulty covering their utilities bills. In another unpopular move, the government liberalised prices on some social goods like milk and bread.

At the beginning of January the government rolled out yet another plan for the economic development of Belarus. As many previous editions of similar documents, the plan contains a lot of well-intended policy initiatives, like creation of the same market conditions for private and state-owned companies. But it remains unclear if or when these policies will be introduced.

Continued financial support for loss-making state-owned enterprises is certainly a step backwards for the reforms. Read more

The Deputy Minister of Finance Maksim Ermolovich in an interview on January 26 also announced a change in the budgeting process, namely a shift to results-oriented budgeting, and equal opportunities for the state-owned and private firms to get financial support from the state.

On the other hand, at the beginning of January the government issued a series of documents offering financial support to several state enterprises. In particular, cement industry enterprises received significant support (around $300m) in the form of government debt guarantees.

Several glasswork factories received significant support, as well as light industry enterprises like Kamvol, one of the largest textile producers. Continued financial support for loss-making state-owned enterprises is certainly a step backwards for the reforms. The departure from directed lending and other forms of support for uncompetitive enterprises is one of the main recommendations from both independent experts and the IMF.

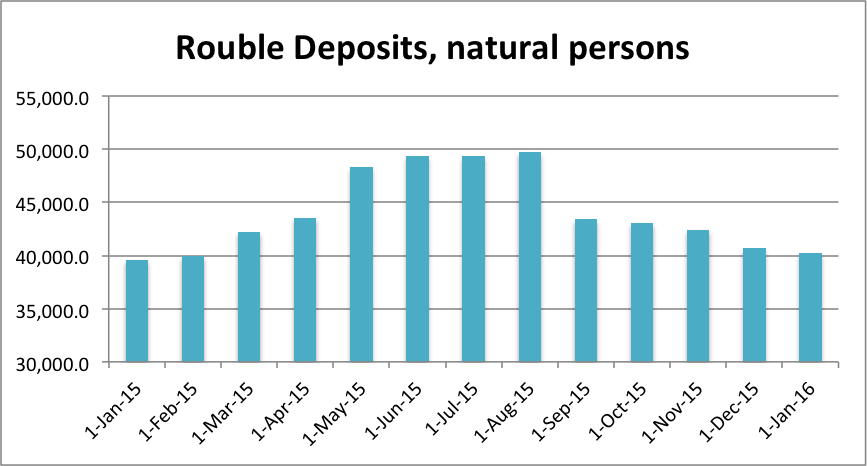

Deposit outflow

Rouble deposits of natural persons continue the decline that they started in August 2015. On 1 January 2016 people held BYR40,204bn in bank deposits, just slightly higher than the amount held a year ago, and much lower than on 1 August.

There are several reasons for this deposit outflow (which is very significant, especially given the average deposit rates of 20-25 per cent). The National Bank decree that came into force in November 2015 introduced income tax for the interest earned from transferable deposits to motivate long-run non-transferable deposits.

Several rounds of fast and unpredicted depreciation in August and November 2015 also contributed to the reduction of trust in the national currency. Combination of these factors also made it difficult to speculate on high rouble deposit rates. Another important factor in the deposit outflow is the decrease in real incomes – given the drop in wages people save less, and some of them probably had to spend some of their savings.

In January the depreciation of the rouble continued. No one expects real incomes to increase either, and the deposit outflow will most probably continue. The outflow of rouble deposits is not a huge threat to the banking system – the National Bank can print roubles and be the lender of last resort. However, if the outflow of currency deposits starts, it will be much more difficult for the National Bank to stabilize the situation.

Given the uncertainty in the oil price outlook, and the fragile state of the currency reserves, the Belarusian government and the National Bank have a difficult task to accomplish. Preserving financial stability without financial support from the outside seems impossible, and the IMF loan looks like the best option to both get the funds and receive impetus for reforms.

Kateryna Bornukova, BEROC

This article is a part of a joint project between Belarus Digest and Belarusian Economic Research and Outreach Center (BEROC)

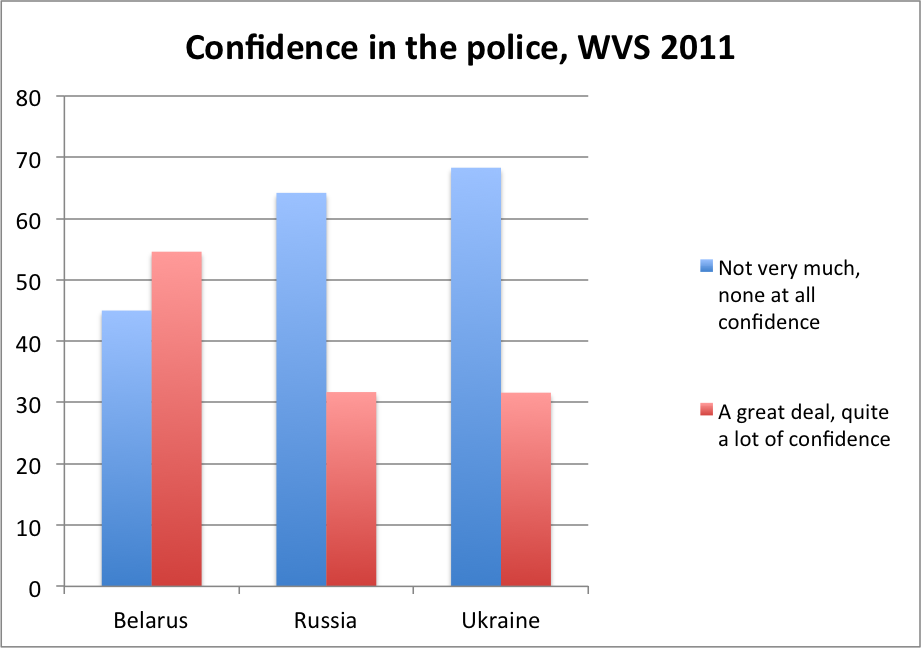

To be fair, the situation is much direr in neighbouring Russia and Ukraine, where corruption and violence are even more pervasive. Tabulating 2011 World Values Survey data indicates that the Belarusian police are not doing so poorly in comparison.

To be fair, the situation is much direr in neighbouring Russia and Ukraine, where corruption and violence are even more pervasive. Tabulating 2011 World Values Survey data indicates that the Belarusian police are not doing so poorly in comparison.