The end of a long-lasting recession? – Digest of the Belarusian economy

On 17 May 2017, Belstat, Belarus's official statistical body, announced that Belarus's economy is growing for the second straight month.

Thus, on 24 May, Deputy Prime Minister Vladimir Semashka declared new investment plans for the industrial sector assuming further economic recovery.

Nevertheless, the economic environment remains complex and the debt burden of enterprises is high, threatening the stability of the banking system.

Economic growth: good prospects for the future

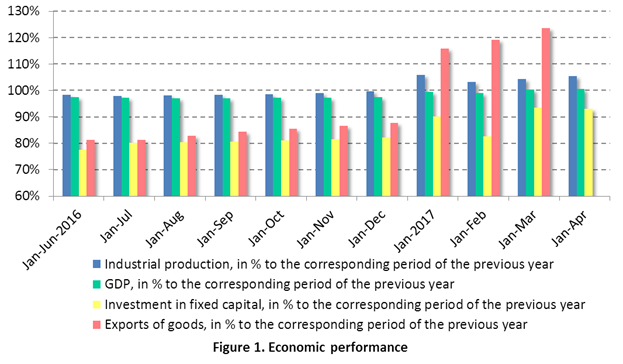

On 17 May, Belstat announced that in January-April, GDP increased by 0.5 per cent in comparison with the corresponding period of the previous year, thus extending March's positive dynamics (see Figure 1).

The main contributor to the recent economic growth remains export. Figures for the first quarter of the year indicate that export of goods has increased by 20 per cent, thanks to the steady recovery of the Russian economy and increase in consumer demand for Belarusian food products.

Another key factor is that the export of oil refinery products has risen from the ashes after the upward correction of world oil prices and a long-awaited deal with Russian authorities on oil import. This will mostly add up in the second half of the year.

According to economist Vyacheslav Yaroshevich, the Russia-Belarus oil deal will encourage the entire economy, thus resulting in 30 per cent year-on-year export growth and an additional 0.7 per cent GDP growth by the end of May.

Furthermore, in the second half of the year, industrial production will also start contributing to overall GDP growth. According to Vyacheslav Yaroshevich, the industry shows signs not only of growth in production volumes, but also improvements in the financial situation, including increase in revenues, efficiency of sales, and net profits.

The financial sector: disappearing savings

According to data from the National Bank of Belarus, as of 1 May 2017 the amount of foreign currency deposits in banks amounted to $6.8bn – the lowest since December 2013. This trend of constant decline in foreign-currency savings has been observable since November 2015. As a result, after 18 months, savings declined by almost $1bn.

Three factors explain this trend. First is the the constant decrease in the profitability of deposits for Belarusians both in foreign and national currency.

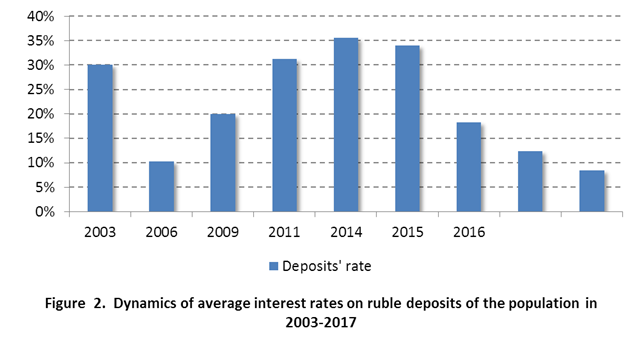

For many years, the deposit rates on bank savings nominated in Belarusian rubles exceeded two-digit numbers. Even during periods when the Belarusian ruble was stable (the 2000s – a period of generous oil subsidies), their yield came to more than 10 per cent per year. Only in the summer of 2006, due to declining inflation, did the average deposit rate fall to 9.7 per cent.

Over the next decade, it was always expressed in double figures due to the high inflation rate. It even exceeded 50 per cent per annum during the 2011 and 2014 financial crises. However, in 2015-2017, after the National Bank of Belarus committed to reduce inflation, these rates dropped to the historically low level of 8.4 per cent. They will supposedly continue to decrease (see Figure 2).

The second factor is that there are very few profitable investment projects for banks to finance. Moreover, on 1 May, the share of bad assets (generated by current operations of enterprises) in Belarusian banks reached 14.2 per cent.

According to the Senior Director of the Moscow office of Fitch Ratings, Olga Ignatieva, the quality of assets in banks will continue to deteriorate, as the economic environment is complex and the debt burden of enterprises remains high. Thus, banks have less motivation to attract new deposits.

Finally, Belarusians, who are facing a decline in their real incomes, try to maintain the same level of consumption at the expense of their savings.

Manufacturing sector: modernization 2.0

On 24 May, Deputy Prime Minister Vladimir Semashka announced plans to invest $500mln in the modernization of MAZ (the largest manufacturer of trucks in Belarus), $800-850mln in the development of BMZ (a large metallurgical plant), and commit additional financial resources to the modernization of refineries.

According to Vladimir Semashka, MAZ struggles with production volumes. Three years ago, the enterprise produced 24,000 trucks per year, whereas by the end of 2017 it was producing no more than than 11,000. The refineries performed better, but endured financial losses due to the drop in world oil prices and the decrease in oil suppliers from Russia in 2016.

However, in light of the absence of internal financial resources, the government has only two options if it wants to fulfil its plans for modernization and foreign direct investments.

According to the opinion of economists from the investment company UNITER, Belarus must increase the annual inflow of foreign direct investments (FDI) to $3-4bn if it wants to increase economic development. However, data for 2013-2016 shows that the volume of FDI has stabilised at $1.3-1.5bn per year without significant changes in recent years.

The second option is obtaining loans from international financial organisations. Once again, negotiations with the IMF remain incomplete (nobody knows for how long), and the Eurasian Development Bank still requires more profound reforms in the Belarusian state sector (including privatisation).

Thus, in May, Belarus's economy showed its first signs of recovery – the rise in export and industrial production point to positive prospects for the second half of the year. However, problems in the financial system, which have accumulated over the previous years, have not disappeared. This threatens the sustainability of the economy.

Aleh Mazol, Belarusian Economic Research and Outreach Center (BEROC)

This article is a part of a joint project between Belarus Digest and Belarusian Economic Research and Outreach Center (BEROC)

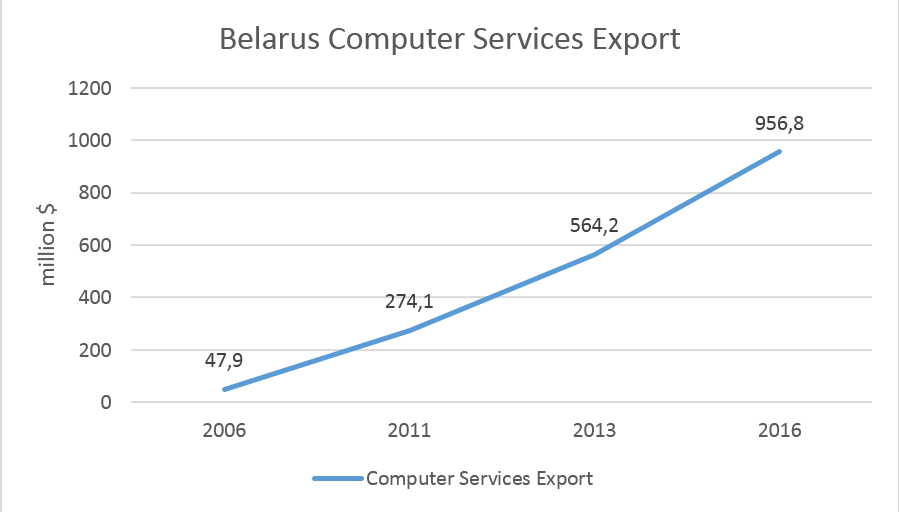

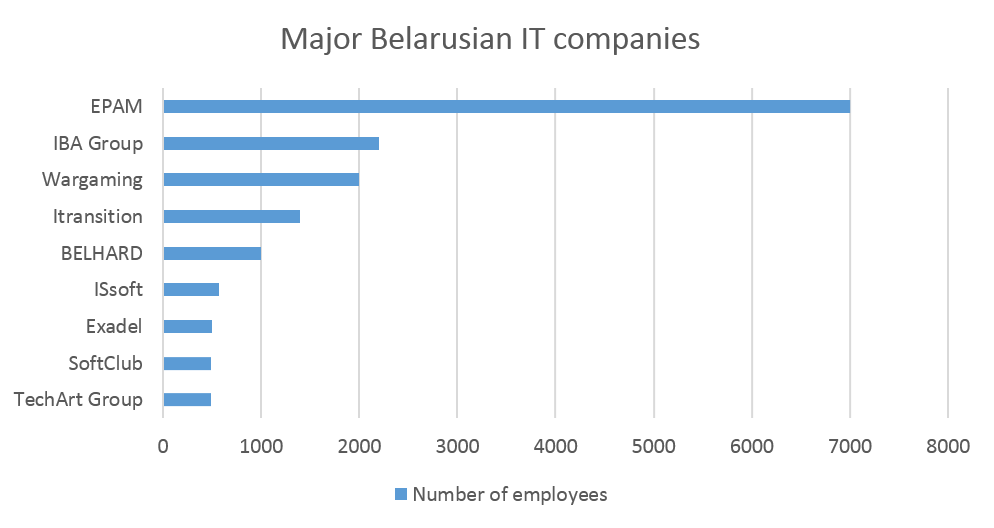

Given the overall economic decline, the authorities see the IT industry as a

Given the overall economic decline, the authorities see the IT industry as a  Therefore, most Belarusian IT students have deep knowledge of their subject and participate in numerous national Olympiads and international competitions. For example, Belarusian sport programmer Hienadź Karatkievič won the Google Code Jam competition three times in a row in 2014-2016, breaking the world record. What’s more, Belarusian students won several prizes in the IEEEXtreme competition, International Mathematics Competition, and Informatics Olympiad. Such results demonstrate the high level of technical and scientific knowledge that allows Belarusian programmers to compete with their rivals from Western countries.

Therefore, most Belarusian IT students have deep knowledge of their subject and participate in numerous national Olympiads and international competitions. For example, Belarusian sport programmer Hienadź Karatkievič won the Google Code Jam competition three times in a row in 2014-2016, breaking the world record. What’s more, Belarusian students won several prizes in the IEEEXtreme competition, International Mathematics Competition, and Informatics Olympiad. Such results demonstrate the high level of technical and scientific knowledge that allows Belarusian programmers to compete with their rivals from Western countries. In some cases, Belarusian emigrants contribute to IT growth by bringing leading software enterprises back to their home country. This was the case for

In some cases, Belarusian emigrants contribute to IT growth by bringing leading software enterprises back to their home country. This was the case for